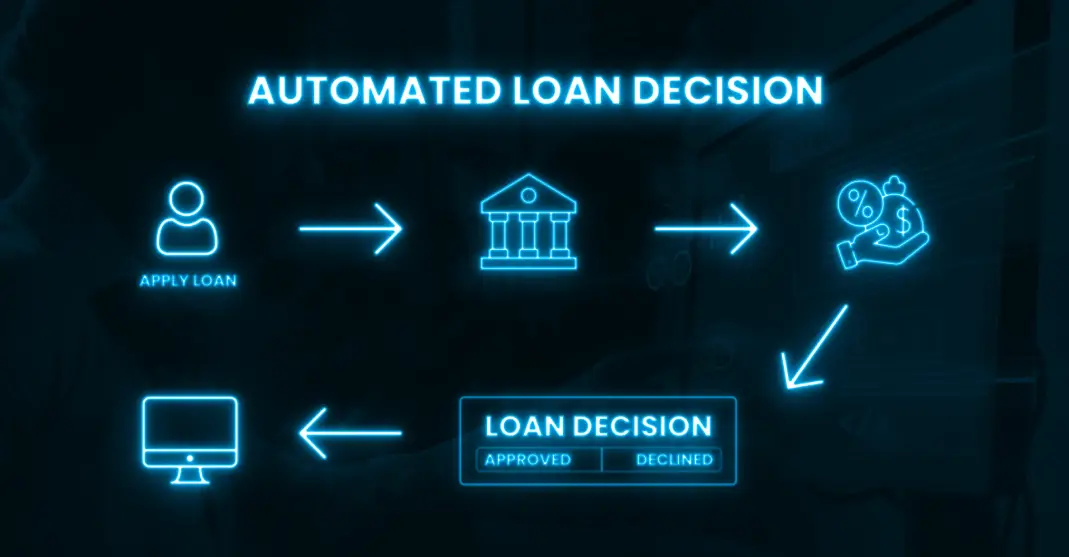

Automated & Effortless Loan Decisioning, Anytime

Our cutting-edge System (Jerry) ensures fast, reliable, and automated loan decisions 24/7—even on weekends and holidays. No delays, no downtime—just seamless approvals that keep your business moving. With minimal human input, reducing errors and accelerating your workflow.Whether it’s day or night, our system is always on, making lending more efficient and accessible than ever.

Banking Data Integration

Clients securely connect their banking data through a trusted third-party provider, which then transmits the necessary financial information to our system for accurate and real-time loan decision-making.

Built to Grow with Your Business

As your company expands, Jerry scales with you—capable of processing multiple loan applications simultaneously, delivering fast and accurate decisions in under 1 minute. We’re not just a platform; we’re a partner. Our dedicated support team is always ready to assist you—reach out anytime sales@fintectfinancial.ca. With us, your growth knows no limits.